Visualize Semiconductor Supply Chain

Our digitally-driven society is powered by an extremely robust semiconductor supply chain, and until the COVID-19 pandemic, not many people thought about it.

But a sudden surge in demand for digital goods, improved technologies, and recovering economies put the strain and spotlight directly on semiconductors.

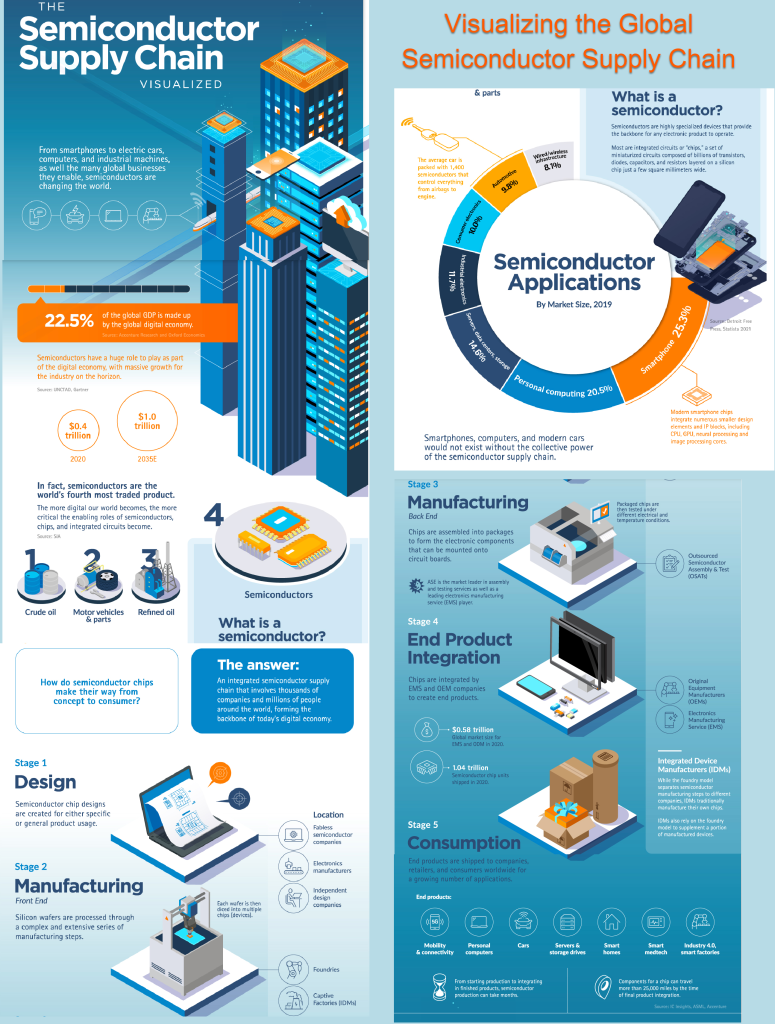

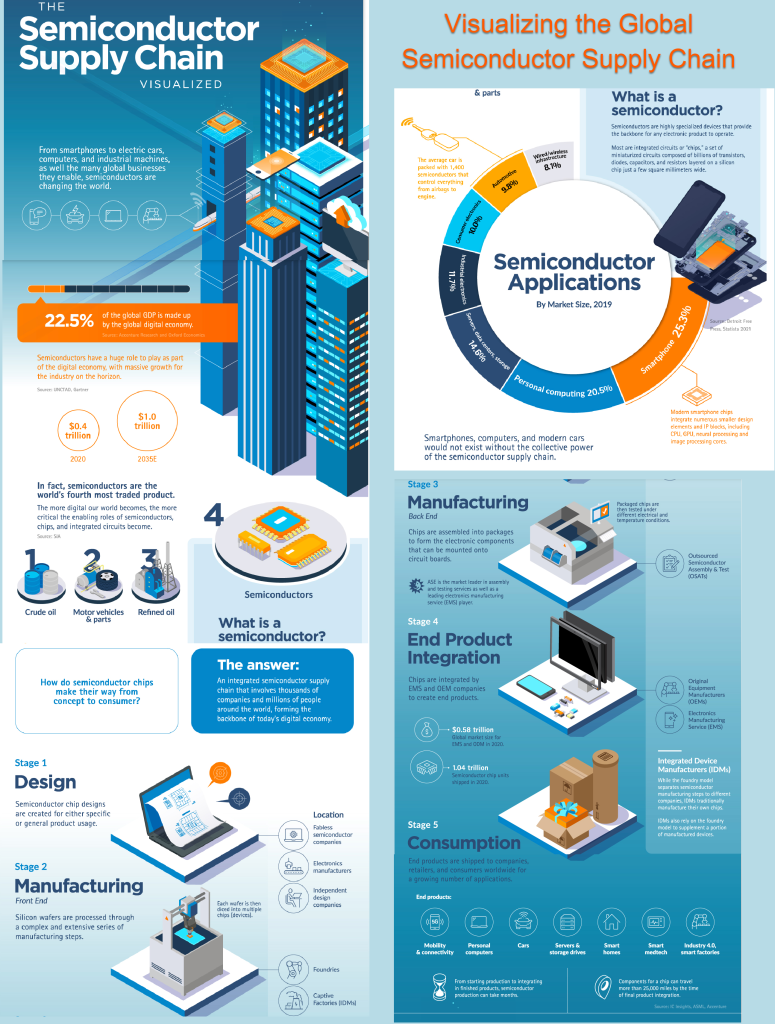

The millions of digital devices we use, from smartphones to electric cars, computers, robotics, and the businesses they enable, only function thanks to the intricate chips built on semiconductors. By some estimates, up to 22.5% of global GDP is made up by the global digital economy.

This graphic from ASE Global highlights the complex and global semiconductor supply chain that powers our modern world.

How Important are Semiconductors and Chips?

Fully understanding the importance of semiconductors to the modern world is sometimes tricky, especially when the devices themselves are so small.

But a semiconductor device—also known as an integrated circuit (IC) or chip—actually contains many smaller circuits comprised of millions of transistors, all packed onto a few millimeters of silicon (the semiconductor).

These semiconductor devices allow electronics to make computations, and in essence, function and operate. That makes them vital for modern electronics, with semiconductors being the fourth-most traded product in the world behind crude oil, motor vehicle parts, and refined oil.

Semiconductor Applications by Market Market Size

- Smartphone 25.3%

- Personal Computing 20.5%

- Servers, Data Centers, Storage 14.6%

- Industrial Electronics 11.7%

- Consumer Electronics 10.0%

- Automotive 9.8%

- Wired/wireless Infrastructure 8.1%

Modern smartphones, for example, utilize semiconductor devices with many different smaller integrated circuits for different functions. For example, these modern chips can include the phone’s CPU, GPU, neural processing, and image processing cores.

And as the recent strain on automotive manufacturing demonstrated, semiconductors are even vital for vehicles. Cars are packed with up to 1,400 semiconductor devices controlling everything from airbags to the engine, and electric vehicles utilize even more.

What the Semiconductor Supply Chain Looks Like

So how do these complex devices make their way from concept to your devices?

An integrated semiconductor supply chain that involves thousands of companies, millions of people, and billions of dollars. The chain can be broken up into stages which happen across the globe, better known as the foundry model:

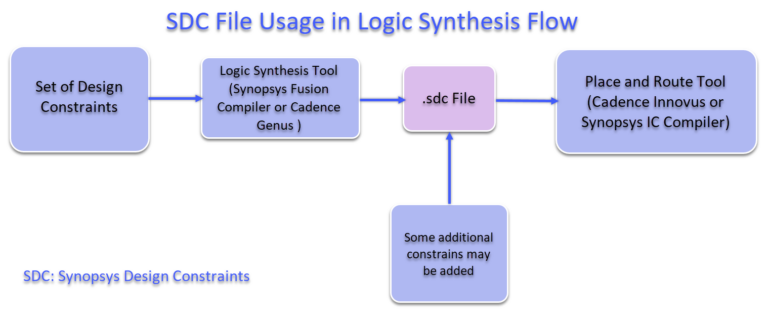

Design: Semiconductor chip designs are created for specific or general device usage.

Manufacturing (Front End): Silicon wafers are processed through an extensive series of manufacturing steps then diced into multiple chips (also called dies or devices).

Manufacturing (Back End): Chips are layered and assembled into packages that can be mounted onto circuit boards. Packaged chips are then tested under different electrical and temperature conditions.

End Product Integration: Chips are integrated by electronics and equipment manufacturers to create end products for consumers.

Consumption: End products are shipped to companies, retailer, and consumers worldwide.

The entire process, from starting design and production to end product integration, takes months. But in the end, those manufactured chips end up in smartphones, computers, cars, servers, smart homes, and other technology all around the globe.

Different Types of Companies in Semiconductor Manufacturing

In 2020, despite an economic slowdown from the pandemic, an estimated 1.4 trillion semiconductor chip units were shipped around the globe.

Those chips were manufactured by many types of companies that occupy different parts of the supply chain. Some are household names in electronics, while others are lesser-known manufacturing stage companies responsible for most of the world’s chip consumption.

These companies operate under the foundry model, which is also known as fabless design. The model outsources different stages of production to specialized companies:

Fabless semiconductor companies and electronics manufacturers (and independent design companies) create the design and specifications required for their chips.

Foundries are contracted to manufacture the designed chips.

OSAT (outsourced semiconductor assembly and test) companies assemble, package, and test the chips for consumption. ASE Global is the market leader in assembly and testing services, capturing 30% of the global OSAT market in 2021.

OEM (original equipment manufacturers) and contracted EMS (electronics manufacturing service) companies integrate the packaged chip into devices. ASE Global is also a leading EMS provider, and over the course of the company’s history, has helped manufacture more than three trillion chips.

Devices are then sold by the fabless companies and electronics manufacturers at the start of the chain.

At the same time, there are also IDMs (integrated device manufacturers) that design, manufacture and sell their own chips. This was the traditional model of chip development and IDMS generally weren’t considered a part of the foundry model, but many IDMs now outsource part of their production cycles as well.

Unlocking the Potential of the Digital Economy

The companies that make up the semiconductor supply chain are spread all over the globe, from the U.S. to China, South Korea, Taiwan, and Germany. A finished chip can contain components that have traveled more than 25,000 miles by the time of final product integration.

It’s a complicated but necessary supply chain that empowers the technology of the present and the future. From advances in 5G and AI to smart factories and advances in automotive and quantum computing, the companies in the semiconductor supply chain make it all possible.

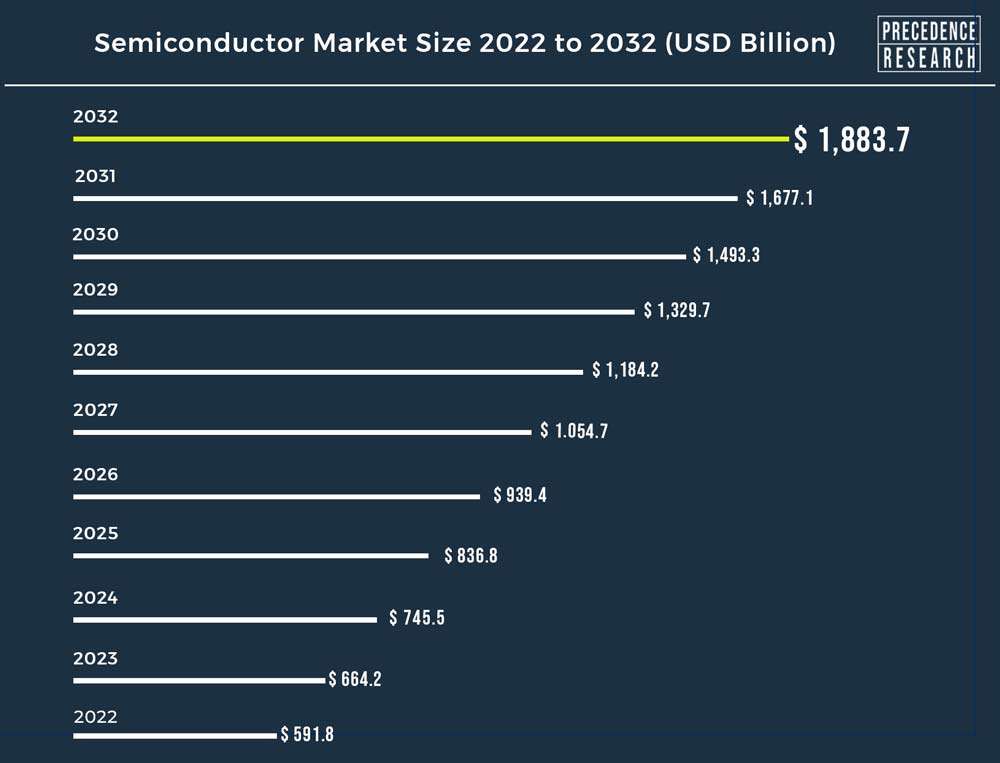

Semiconductor Market Size Projected to Reach USD 1,883.7 Billion By 2032

The global semiconductor market size surpassed USD 591.8 billion in 2022 and is projected to reach around USD 1,883.7 billion by 2032, expanding at a double digit CAGR of 12.28% from 2023 to 2032.

The semiconductor market is driven by the growing consumer electronic industry, technological advancements and rising investment. In addition, the growing demand for semiconductor components from the automotive sector is expected to propel the market growth during the forecast period.

A semiconductor is a material with electrical conductivity between that of a conductor and an insulator. The conductivity of a semiconductor can be controlled and modified by factors such as temperature, light, or the addition of impurities, a process known as doping. This ability to manipulate conductivity makes semiconductors a crucial component in electronic devices. The most common semiconductor material is silicon, but other materials like germanium and gallium arsenide are also used. Semiconductors are fundamental to the operation of various electronic components, including transistors, diodes, and integrated circuits. These components form the basis of modern electronics and are essential in the construction of devices such as computers, smartphones, and other electronic systems. The field of semiconductor physics and technology has played a pivotal role in the development of the digital age. The market is majorly driven by the increasing number of product launches.

Regional Stance

Asia Pacific is expected to dominate the market during the forecast period. The market growth in the region is attributed to the growing investment in the semiconductor industry particularly in China and India. For instance, according to secondary sources, approximately USD 40 billion was spent in the semiconductor sector by the Chinese government. In the fight to control the manufacture of high-end chips, the nation attempts to overtake the US and other competitors. Furthermore, plans to establish a private-sector task force to improve cooperation between the US Semiconductor Industry Association (SIA) and the India Electronics and Semiconductor Association (IESA) in the global semiconductor ecosystem were revealed in January 2023.

North America is expected to grow at a substantial rate over the forecast period. The market expansion is ascribed to the growing R&D investment. According to the Semiconductor Industry Association, the U.S. semiconductor sector invested a total of $58.8 billion in research and development in 2022. Over the past 20 years, annual R&D expenses as a percentage of sales have topped 15 percent. Among the main manufacturing sectors of the US economy, this rate is unparalleled. Furthermore, the region’s expanding 5G infrastructure presents a possible opportunity for the semiconductor sector.

Component Insights

The MPU and MCU segment is expected to hold the largest market share during the forecast period. An MPU, or microprocessor, is a central processing unit (CPU) that performs arithmetic and logic operations in a computer. It serves as the brain of a computer or electronic device, executive instructions and coordinating the overall operation of the system. Whereas a microcontroller (MCU), is a compact integrated circuit that contains a processor core, memory, and input/output peripherals.

MCUs are designed for embedded systems and are used to control specific functions within electronic devices. The broad use of MPUs and MCUs in the production of devices including PCs, laptops, desktops, and notebooks has historically greatly aided in the expansion of this market. The increasing trend of IoT devices and their corresponding demand is driving up demand for powerful processors and controllers, which is driving up the MPU and MCU sectors’ growth.

Application Insights

The networking & communications segment is expected to capture a significant market share over the projected period. The proliferation of wireless communication technologies, including Wi-Fi, Bluetooth, and cellular networks (4G and 5G) is a significant driver for semiconductor companies. The demand for wireless connectivity in smartphones, IoT devices, and other wireless-enabled products fuels the growth of this segment.

Furthermore, the increasing demand for high-speed data transmission has led to increased investments in fiber optics and optical networking. Semiconductors play a crucial role in the development of components such as optical transceivers, amplifiers, and switches for optical communication systems. Thus, this is expected to drive the segment expansion.

Semiconductor Market Scope by 2032

[table “4” not found /]Drivers

Increasing use of semiconductors in automobiles

The market’s shift toward autonomous, connected, electric, and sharing (ACES) mobility is the main factor driving the automobile industry’s increased semiconductor usage. Advanced driver assistance systems, or “ADAS,” are becoming commonplace in most new cars. These features, which include parallel parking, adaptive cruise control, automated braking, blind spot monitoring, and adaptive cruise control, are laying the groundwork for eventually having completely autonomous cars. The majority of new cars are equipped with connectivity capabilities like Bluetooth, wireless internet, and navigation systems as standard, with advancements in vehicle-to-vehicle and vehicle-to-infrastructure communication being made.

In addition, compared to conventional internal combustion engine automobiles, automakers are selling a growing percentage of hybrid and electric vehicles. The transition to ACES mobility is happening faster due to stricter safety and pollution rules, rising customer demand for comfort, and increasing vehicle performance. Hybrid electric cars can have up to $1,000 and 3,500 semiconductors in them, compared to an average of $330 in conventional automobiles. Thus, this is expected to propel the semiconductor industry during the forecast period.

Restraint

High R&D cost and complex manufacturing

Developing cutting-edge semiconductor technologies requires substantial investments in research and development. The high cost of R&D can be a challenge for smaller companies and may impact profit margins for larger companies. In addition, the fabrication of semiconductor devices involves intricate manufacturing processes. Any disruptions or issues in these processes can lead to delays, increased costs, and reduced yields, affecting the overall market performance. Therefore, the high cost of R&D and complex manufacturing process is expected to hamper the market expansion during the forecast period.

Opportunity

Increasing collaboration

The increasing collaboration is expected to propel the market growth during the forecast period. For instance, in December 2023, a memorandum of understanding (MoU) was struck by major technology giant Siemens AG and one of the biggest semiconductor businesses in the world, Intel Corporation, to work together to advance the digitalization and sustainability of microelectronics production. For example, the partnership will investigate the application of “digital twins” of intricate, extremely capital-intensive manufacturing facilities to standardize solutions where each percentage increase in efficiency has a significant impact.

Along with reducing energy usage, the partnership will investigate sophisticated modeling of natural resources and environmental footprints along the whole value chain. Intel will work with Siemens to investigate product- and supply chain-related modeling solutions that generate data-driven insights and facilitate the industry’s acceleration of efforts to reduce its overall environmental impact to obtain more information on emissions connected to products.